Keep Your Email and Banking Safe Online

Keep Your Email and Banking Safe Online – Simple Steps to Stay Protected

Introduction: Your Digital Life Deserves Protection

Think of your email and online banking accounts as the front doors to your digital life. Just like you wouldn’t leave your house unlocked, you shouldn’t leave these accounts vulnerable. Hackers and scammers are always looking for easy targets—don’t let that be you! This guide will walk you through easy, practical steps to lock down your accounts and browse the web with confidence.

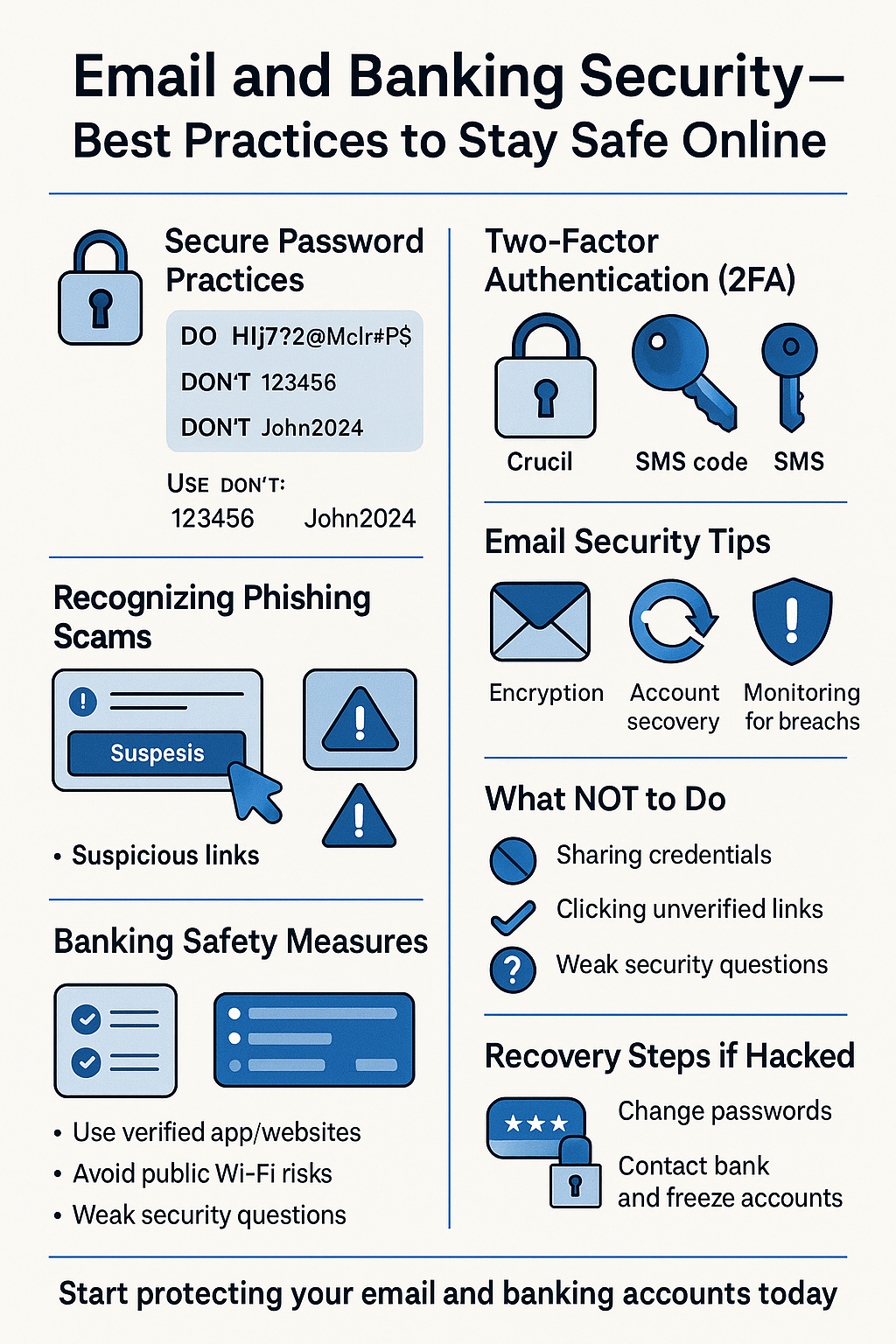

1. Strong Passwords: Your Digital Lock & Key

Why it’s important:

Weak or reused passwords are like leaving your keys under the doormat—hackers love them.

What you should do:

✅ Make passwords long and strong – Mix letters (upper and lowercase), numbers, and symbols. Example: "Sunset@Beach#2024!" is way better than "password123."

✅ Never reuse passwords – If one account gets hacked, the rest could too.

✅ Use a password manager – Apps like Bitwarden or LastPass remember all your passwords so you don’t have to.

Avoid:

- Simple passwords like "123456" or "qwerty"

- Personal info like birthdays or pet names

2. Two-Factor Authentication (2FA): An Extra Lock on the Door

Why it’s a game-changer:

Even if someone steals your password, 2FA stops them from getting in.

Best options:

- Authenticator apps (Google Authenticator, Authy) – More secure than text messages.

Hardware keys (YubiKey) – The strongest protection (great for banking).

⚠ Avoid SMS codes – Hackers can trick phone companies into sending codes to them instead.

3. Spotting Scams: Don’t Get Tricked!

Common scams:

"Your bank account is locked! Click here to fix it!" (Fake emails)

"Hi, this is Amazon support. We need your password." (Fake calls/texts)

How to stay safe:

Check the sender’s email – Is it really from your bank? (e.g., support@paypal.com vs. paypalsecurity@scam.com)

Hover before clicking – Does the link match the real website?

Watch for urgency – Scammers rush you to act before you think.

Real-life example:

Someone got a text saying their Netflix account was frozen. They clicked, logged in, and lost their account. Always go to the real website yourself!

4. Email Safety: Keep Hackers Out of Your Inbox

Use encrypted email (like ProtonMail) for sensitive info.

Set up account recovery – Use a backup email/phone only you control.

⚠ Never email passwords or bank details – Email isn’t private!

Check for breaches:

Visit HaveIBeenPwned.com to see if your email was leaked in a hack.

5. Banking Safely: Guard Your Money Like a Pro

Only use official apps/websites

– Look for "https://" and the correct bank name.

Avoid public Wi-Fi for banking – Use mobile data or a VPN instead.

Turn on transaction alerts – Get notified for every login or payment.

✅ Safe Banking Checklist:

✔ Verified app

✔ VPN or mobile data (not public Wi-Fi)

✔ Instant alerts

✔ Always log out when done

6. Bad Habits to Break Now

Sharing passwords over email/text

Using the same password everywhere

Clicking sketchy links (even from friends)

Skipping software updates (they fix security holes!)

Easy security questions ("What’s your pet’s name?" is easy to guess)

7. If You Get Hacked: Act Fast!

1️⃣ Change all passwords (starting with email & banking).

2️⃣ Turn on 2FA everywhere.

3️⃣ Call your bank to freeze suspicious activity.

4️⃣ Scan for viruses/malware

5️⃣ Report it to your bank and local cybercrime agency.

Take Action Today – Before It’s Too Late!

Hackers move fast—don’t wait until it’s too late!

Download a password manager.

Enable 2FA on important accounts.

Double-check banking links.

Run a security check on your email.

A few minutes now can save you from a huge headache later. Stay safe out there!

Comments ()